VMware seems to have made February the month of the cloud and is promising 28 days of Cloud Insight (see more here). VMware execs must be pretty confident that they have enough material – as they did not even include the recently (well last week) announced partnership with Google (more here).

So let’s dissect the press release from February 2nd 2015 that kicked off a webinar series lead by VMware CEO Pat Gelsinger and CTO Ben Fathi.

SAN FRANCISCO, CA--(Marketwired - February 02, 2015) - VMware, Inc. (NYSE: VMW) today announced VMware vSphere® 6, the newest edition of the industry-defining virtualization solution for the hybrid cloud and foundation for the software-defined data center. With more than 650 new features and innovations, VMware vSphere 6 will provide customers with a highly available, resilient, on-demand cloud infrastructure to run, protect and manage any application. VMware vSphere 6 will be complemented by the newest releases of VMware vCloud® Suite 6, VMware vSphere with Operations Management™ 6, and VMware Virtual SAN™ 6.

MyPOV – Basically VMware is following through on the announcements made at VMWorld in summer of 2014 (my takeaways here) – and delivering the ‘6’ product family in Q1 2015 as announced back then.

[VMware points out correctly these products were not announced back at VMworld - but general features and capabilities not slotted to a specific release. They now ship as part of the '6' product family.]

VMware today also re-enforced its support of open frameworks for building and managing clouds with its new VMware Integrated OpenStack distribution. This first-ever OpenStack distribution from VMware will empower IT to provide developers with open API access to enterprise-class VMware infrastructure. Additionally, VMware revealed a technology preview that will enable customers to bridge the public and private cloud through the combination of VMware NSX™ network virtualization and VMware vCloud® Air™, VMware's public cloud service, to enable a single, secure network domain.

MyPOV – True to the announcements VMware is also delivering OpenStack capabilities, who are badly demanded by their customers. The concern is that in this case, with its own distribution, VMware may do (or hopefully not) the one or other things to break OpenStack or make it only work with its products (of course I speculate here). But customers may be ready to accept that for the pure benefit to run more of VMware with OpenStack tools. We still need to understand the timeline of the ‘technology preview’ mentioned above.

"As our customers accelerate growth, their IT organizations are expected to drive transformation, enhance efficiency and bring more value to the business than ever before," said Ben Fathi, chief technology officer, VMware, Inc. "We are helping them achieve these goals through continued innovation in VMware vSphere as the platform for their hybrid cloud strategy. VMware vSphere is the gold standard by which all other virtualization technologies are measured, and vSphere 6 raises the bar even higher."

MyPOV – Fair ambition for VMware, but it is time to be able to understand local data center load and move it to the cloud. VSphere still does (too) little for that. We may to wait for (hopefully) later in the month VCloud Air announcements.

In other news today, VMware announced the industry's first unified platform of virtualized compute, networking and storage for the hybrid cloud (read the news announcement), as well as new innovations for software-defined storage including VMware Virtual SAN 6 and vSphere Virtual Volumes™ (read the news announcement).

MyPOV – Key announcements for VMware customers, who should check them out if they have upcoming storage products.

VMware vSphere 6 - The Foundation for Hybrid Cloud

Unveiled today, VMware vSphere 6 will deliver breakthrough new capabilities to address the unique needs of business-critical and cloud-native applications, and drive higher performance, scale and consolidation ratios. VMware vSphere 6 will also re-define infrastructure and application service-levels and availability. New capabilities and features include:

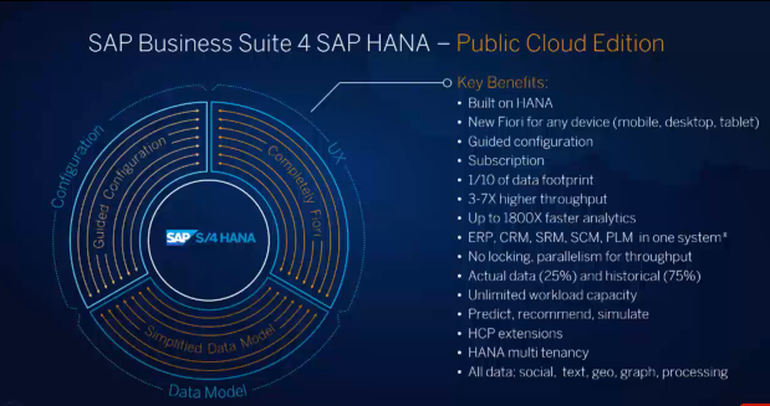

Broad Application Support - VMware vSphere 6 will address the specific challenges of cloud-native applications, including agile development cycles and multiple application instances. With VMware vSphere 6, organizations will be able to manage thousands of component instances of a single cloud-native application. New scale, performance and availability capabilities also make vSphere 6 the platform of choice for virtualizing scale-up applications such as SAP HANA, scale-out workloads such as Hadoop, and business-critical applications such as Microsoft SQL Server, Oracle Database, and SAP ERP.

>> MyPOV – Working well with a number if ISVs has always been VMware’s strength. That VMware can keep these relationships going in the cloud age will be a key development to keep an eye on – as most of the current partners have made commitments to their own cloud infrastructures. At some point e.g. SAP customers will think SAP will run better on the SAP cloud, Oracle products will run better in the Oracle cloud etc. – even if de-facto not a true development.

New Long-Distance Live Migration Capabilities - VMware vSphere 6 introduces Long-Distance motion®, which will enable zero downtime live migration of workloads over long distances such as New York to London. With multi-processor fault tolerance, another industry first, customers will benefit from continuous availability for larger virtual machines up to four virtual-CPUs.

MyPOV – This is a key (and long overdue) feature for VMware. Probably the best received and equally badly needed feature at VMWorld 2014 in San Francisco. With the long distance capability VMware takes away a lot of overhead and headache for its customers. A very good move in my view, now VMware needs to make sure the pricing is so attractive that customers will shelve the workarounds they have in place for this today.

Instant Clone Technology - Introduced as Project Fargo, a technology preview at VMworld® 2014 San Francisco, VMware's Instant Clone technology will make it possible to rapidly clone and provision thousands of container instances and virtual machines to make new virtual infrastructure available in sub-second timeframes.

MyPOV – A key feature added by VMware which keeps VMware relevant as infrastructure player even for more advanced organizations that run, build and have to maintain next generation applications that heavily rely on container infrastructures.

3D Graphics for Desktop Virtualization - VMware vSphere 6 will enable enterprises to deliver high-end workstation and graphics-intensive applications to virtual desktops such as VMware Horizon® 6 for industries such as engineering, automotive, education and architecture. Using NVIDIA GRID vGPU technology, immersive 3D graphics can be delivered from the cloud enabling greater density, scalable performance and increased cost-savings. Read the NVIDIA and VMware joint announcement.

MyPOV – It’s good to see the VMware efforts from its traditional portfolio and the EUC portfolio coming together. It will also make it real for VMware run EUC on VMware – which is always a great showcase for vendors.

Enterprise-Class Hypervisor-Converged Storage - VMware's flagship will provide enterprise-class scale, performance and new data services making it the ideal storage platform for virtual machines including business-critical applications. Read more about VMware Virtual SAN 6.

MyPOV – Good progress by VMware, storage is inherently non elastic, but bringing software defined storage to VSphere is a key capability to reduce maintenance and operational overhead.

Virtual Machine-Awareness for Third-Party Storage - VMware vSphere Virtual Volumes is the industry's first solution that will enable native virtual machine awareness on a wide range of third-party storage systems, extending VMware's software-defined storage control plane to the ecosystem. Read more about VMware vSphere Virtual Volumes.

MyPOV – Depending how it pans out this could be the most important storage announcement today – as it would allow customers of VMware to control 3rd party storage products. If this is in the interest of these vendors remains to be seen, but kudos for VMware to try brining these together.

Customers can optimize the performance, capacity and configuration health of VMware vSphere 6 with the newly introduced VMware vSphere with Operations Management 6. An integrated platform and management solution, VMware vSphere with Operations Management 6 simplifies infrastructure management with predictive analytics as well as automated recommendation and remediation capabilities. The solution delivers value from day one by helping customers proactively identify and remediate emerging performance and configuration issues and to reclaim any overprovisioned virtual machines along with associated compute, memory and storage resources.

MyPOV – Always good to see the operations / admin console ship with the new feature and not later. Speaks for solid engineering, quality assurance and realistic product delivery timelines.

Also announced today, VMware vCloud Suite 6 will integrate VMware vSphere 6 with the latest releases of its cloud management solutions -- VMware vRealize™ Automation 6.2 and VMware vRealize Operations 6 -- to deliver a private cloud based on a software-defined data center architecture. The latest release will also introduce showback/chargeback and budgeting capabilities via the addition of VMware vRealize Business 6 Standard to further empower infrastructure and operations teams to manage private clouds.

MyPOV – Key capabilities for hybrid cloud and long demanded / expected by VMware customers.

VMware Integrated OpenStack - A Simpler Path to OpenStack

VMware Integrated OpenStack is an OpenStack distribution that will enable organizations to quickly and cost-effectively provide developers with open, cloud-style APIs to access VMware's enterprise-class infrastructure. VMware will package, test and support all components of the distribution, including the open source OpenStack code.

MyPOV – So VMware decides to have its own OpenStack distribution, nothing to be too much afraid of. See my above concerns (and speculation) of VMware being the first to break OpenStack interoperability standards – but VMware will not be the only provider tempted to break the interoperability promise for the sake of better uptake of existing features and capabilities.

With VMware Integrated OpenStack, even IT shops with little or no OpenStack or Linux experience can be up and running with an OpenStack cloud in minutes. The solution will provide full integration with VMware's cloud management platform, enabling customers to leverage existing VMware expertise to manage and troubleshoot an OpenStack cloud.

MyPOV – And here we go – let’s help the SMBs first. As long as decision makers at these SMBs know what they are doing and make decisions with open eyes – good for them.

VMware is also announcing set of new professional services that will provide customers ready access to software development best practices to help implement OpenStack and DevOps projects successfully. VMware added a wealth of experience in designing, implementing and auto-deploying any size OpenStack cloud through its acquisition of MomentumSI, which closed in Q4 2014. Read more about what MomentumSI brought to VMware.

MyPOV – Good to see VMware ramping up the services needed.

The main act for VMware – around vCloud Air – is still to come. It will be key to understand VMware’s progress and status on that crucial product before making ultimate decisions around VMware product adoption and rollout.

----------

More on VMWare by me

So let’s dissect the press release from February 2nd 2015 that kicked off a webinar series lead by VMware CEO Pat Gelsinger and CTO Ben Fathi.

SAN FRANCISCO, CA--(Marketwired - February 02, 2015) - VMware, Inc. (NYSE: VMW) today announced VMware vSphere® 6, the newest edition of the industry-defining virtualization solution for the hybrid cloud and foundation for the software-defined data center. With more than 650 new features and innovations, VMware vSphere 6 will provide customers with a highly available, resilient, on-demand cloud infrastructure to run, protect and manage any application. VMware vSphere 6 will be complemented by the newest releases of VMware vCloud® Suite 6, VMware vSphere with Operations Management™ 6, and VMware Virtual SAN™ 6.

MyPOV – Basically VMware is following through on the announcements made at VMWorld in summer of 2014 (my takeaways here) – and delivering the ‘6’ product family in Q1 2015 as announced back then.

[VMware points out correctly these products were not announced back at VMworld - but general features and capabilities not slotted to a specific release. They now ship as part of the '6' product family.]

VMware today also re-enforced its support of open frameworks for building and managing clouds with its new VMware Integrated OpenStack distribution. This first-ever OpenStack distribution from VMware will empower IT to provide developers with open API access to enterprise-class VMware infrastructure. Additionally, VMware revealed a technology preview that will enable customers to bridge the public and private cloud through the combination of VMware NSX™ network virtualization and VMware vCloud® Air™, VMware's public cloud service, to enable a single, secure network domain.

MyPOV – True to the announcements VMware is also delivering OpenStack capabilities, who are badly demanded by their customers. The concern is that in this case, with its own distribution, VMware may do (or hopefully not) the one or other things to break OpenStack or make it only work with its products (of course I speculate here). But customers may be ready to accept that for the pure benefit to run more of VMware with OpenStack tools. We still need to understand the timeline of the ‘technology preview’ mentioned above.

"As our customers accelerate growth, their IT organizations are expected to drive transformation, enhance efficiency and bring more value to the business than ever before," said Ben Fathi, chief technology officer, VMware, Inc. "We are helping them achieve these goals through continued innovation in VMware vSphere as the platform for their hybrid cloud strategy. VMware vSphere is the gold standard by which all other virtualization technologies are measured, and vSphere 6 raises the bar even higher."

MyPOV – Fair ambition for VMware, but it is time to be able to understand local data center load and move it to the cloud. VSphere still does (too) little for that. We may to wait for (hopefully) later in the month VCloud Air announcements.

In other news today, VMware announced the industry's first unified platform of virtualized compute, networking and storage for the hybrid cloud (read the news announcement), as well as new innovations for software-defined storage including VMware Virtual SAN 6 and vSphere Virtual Volumes™ (read the news announcement).

MyPOV – Key announcements for VMware customers, who should check them out if they have upcoming storage products.

| VMware products announced February 2nd 2015 (from Webcast) |

VMware vSphere 6 - The Foundation for Hybrid Cloud

Unveiled today, VMware vSphere 6 will deliver breakthrough new capabilities to address the unique needs of business-critical and cloud-native applications, and drive higher performance, scale and consolidation ratios. VMware vSphere 6 will also re-define infrastructure and application service-levels and availability. New capabilities and features include:

Broad Application Support - VMware vSphere 6 will address the specific challenges of cloud-native applications, including agile development cycles and multiple application instances. With VMware vSphere 6, organizations will be able to manage thousands of component instances of a single cloud-native application. New scale, performance and availability capabilities also make vSphere 6 the platform of choice for virtualizing scale-up applications such as SAP HANA, scale-out workloads such as Hadoop, and business-critical applications such as Microsoft SQL Server, Oracle Database, and SAP ERP.

>> MyPOV – Working well with a number if ISVs has always been VMware’s strength. That VMware can keep these relationships going in the cloud age will be a key development to keep an eye on – as most of the current partners have made commitments to their own cloud infrastructures. At some point e.g. SAP customers will think SAP will run better on the SAP cloud, Oracle products will run better in the Oracle cloud etc. – even if de-facto not a true development.

New Long-Distance Live Migration Capabilities - VMware vSphere 6 introduces Long-Distance motion®, which will enable zero downtime live migration of workloads over long distances such as New York to London. With multi-processor fault tolerance, another industry first, customers will benefit from continuous availability for larger virtual machines up to four virtual-CPUs.

MyPOV – This is a key (and long overdue) feature for VMware. Probably the best received and equally badly needed feature at VMWorld 2014 in San Francisco. With the long distance capability VMware takes away a lot of overhead and headache for its customers. A very good move in my view, now VMware needs to make sure the pricing is so attractive that customers will shelve the workarounds they have in place for this today.

Instant Clone Technology - Introduced as Project Fargo, a technology preview at VMworld® 2014 San Francisco, VMware's Instant Clone technology will make it possible to rapidly clone and provision thousands of container instances and virtual machines to make new virtual infrastructure available in sub-second timeframes.

MyPOV – A key feature added by VMware which keeps VMware relevant as infrastructure player even for more advanced organizations that run, build and have to maintain next generation applications that heavily rely on container infrastructures.

3D Graphics for Desktop Virtualization - VMware vSphere 6 will enable enterprises to deliver high-end workstation and graphics-intensive applications to virtual desktops such as VMware Horizon® 6 for industries such as engineering, automotive, education and architecture. Using NVIDIA GRID vGPU technology, immersive 3D graphics can be delivered from the cloud enabling greater density, scalable performance and increased cost-savings. Read the NVIDIA and VMware joint announcement.

MyPOV – It’s good to see the VMware efforts from its traditional portfolio and the EUC portfolio coming together. It will also make it real for VMware run EUC on VMware – which is always a great showcase for vendors.

Enterprise-Class Hypervisor-Converged Storage - VMware's flagship will provide enterprise-class scale, performance and new data services making it the ideal storage platform for virtual machines including business-critical applications. Read more about VMware Virtual SAN 6.

MyPOV – Good progress by VMware, storage is inherently non elastic, but bringing software defined storage to VSphere is a key capability to reduce maintenance and operational overhead.

Virtual Machine-Awareness for Third-Party Storage - VMware vSphere Virtual Volumes is the industry's first solution that will enable native virtual machine awareness on a wide range of third-party storage systems, extending VMware's software-defined storage control plane to the ecosystem. Read more about VMware vSphere Virtual Volumes.

MyPOV – Depending how it pans out this could be the most important storage announcement today – as it would allow customers of VMware to control 3rd party storage products. If this is in the interest of these vendors remains to be seen, but kudos for VMware to try brining these together.

Customers can optimize the performance, capacity and configuration health of VMware vSphere 6 with the newly introduced VMware vSphere with Operations Management 6. An integrated platform and management solution, VMware vSphere with Operations Management 6 simplifies infrastructure management with predictive analytics as well as automated recommendation and remediation capabilities. The solution delivers value from day one by helping customers proactively identify and remediate emerging performance and configuration issues and to reclaim any overprovisioned virtual machines along with associated compute, memory and storage resources.

MyPOV – Always good to see the operations / admin console ship with the new feature and not later. Speaks for solid engineering, quality assurance and realistic product delivery timelines.

Also announced today, VMware vCloud Suite 6 will integrate VMware vSphere 6 with the latest releases of its cloud management solutions -- VMware vRealize™ Automation 6.2 and VMware vRealize Operations 6 -- to deliver a private cloud based on a software-defined data center architecture. The latest release will also introduce showback/chargeback and budgeting capabilities via the addition of VMware vRealize Business 6 Standard to further empower infrastructure and operations teams to manage private clouds.

MyPOV – Key capabilities for hybrid cloud and long demanded / expected by VMware customers.

VMware Integrated OpenStack - A Simpler Path to OpenStack

VMware Integrated OpenStack is an OpenStack distribution that will enable organizations to quickly and cost-effectively provide developers with open, cloud-style APIs to access VMware's enterprise-class infrastructure. VMware will package, test and support all components of the distribution, including the open source OpenStack code.

MyPOV – So VMware decides to have its own OpenStack distribution, nothing to be too much afraid of. See my above concerns (and speculation) of VMware being the first to break OpenStack interoperability standards – but VMware will not be the only provider tempted to break the interoperability promise for the sake of better uptake of existing features and capabilities.

With VMware Integrated OpenStack, even IT shops with little or no OpenStack or Linux experience can be up and running with an OpenStack cloud in minutes. The solution will provide full integration with VMware's cloud management platform, enabling customers to leverage existing VMware expertise to manage and troubleshoot an OpenStack cloud.

MyPOV – And here we go – let’s help the SMBs first. As long as decision makers at these SMBs know what they are doing and make decisions with open eyes – good for them.

VMware is also announcing set of new professional services that will provide customers ready access to software development best practices to help implement OpenStack and DevOps projects successfully. VMware added a wealth of experience in designing, implementing and auto-deploying any size OpenStack cloud through its acquisition of MomentumSI, which closed in Q4 2014. Read more about what MomentumSI brought to VMware.

MyPOV – Good to see VMware ramping up the services needed.

Implications, Implications

Implications for VMware customers

Good news for VMware customers, always good to see a vendor deliver. The remote instance creation capabilities can become a real option for HA strategies. The container performance should encourage customers with next generation application projects to take note and potentially evaluate the new capabilities. Overall customers need to weigh benefits vs license and implementation costs of the new VMware products.Implications for VMware partners

Equally good news when the main ecosystem anchor delivers. While some longer term opportunities may vanish (e.g. around HA) others may arise (e.g. OpenStack). Partners need to revisit their service and product portfolio in the light of thee substantial product announcements and chart their value adding strategy for the next years, potentially from anew.Implications for VMware competitors

It is clear that VMware is making true on its general features and capabilities partially previewed at VMworld 2014. If a competitor was counting on VMware not delivering, it is bad news for them now. The next months will have to show what impact the new products will have on the market and competitors need to chart their product and marketing strategies accordingly to achieve differentiation.Overall MyPOV

Always good for a vendor to make true for their announcements. Many of the new capabilities VMware announced and now delivered are not ‘low hanging fruit’ – so congrats to the VMware R&D teams to bring it here. Now it’s back to customers to evaluate the benefit / cost relationship of the new VMware products, where some areas look favorable, others look more difficult. Customers should be aware of alternatives and weigh their options accordingly. On the flipside VMware offers one integrated data center platform that is engineered and tested together – so when VMware delivers on that with good quality – it is a very valuable platform for customers.The main act for VMware – around vCloud Air – is still to come. It will be key to understand VMware’s progress and status on that crucial product before making ultimate decisions around VMware product adoption and rollout.

----------

More on VMWare by me

- Speed Briefings at VMworld - read here

- Event Report - VMware makes a lot of progress - but the holy grail is still missing - read here.

- First Take - VMware's VMworld Day 1 Keynote - Top 3 Takeaways - read here.

- Progress Report - Good start for VMware EUC - time for 2nd inning - read here.

- Speed Briefings at VMworld - inside and outside the VMware ecosystem - read here.

- VMware defies conventional destiny - SDDC to the rescue - read here.

.jpg)