We had the opportunity to attend the WorkForce Software Vision 2017 user conference held in New Orleans from March 13th till 15th 2017. The even was well attended with over 260 attendees, managing a collective 500k employees.

Here is my event video of the event:

No time to watch – here is the 1 slide update:

Find more coverage on the Constellation Research website here and checkout my magazine on Flipboard and my YouTube channel here.

Here is my event video of the event:

No time to watch – here is the 1 slide update:

If you want more details – read on:

Focus on Product and more– Always good to see vendors focusing on product, in the case of WorkForce Software, CEO Morini shared that the vendor will add 80 more developers. For a 600 employee company a substantial investment. Likewise WorkForce Software has shown progress on the partner side (more large SIs are on board), it appears the reseller relationship with SAP is going well, and lastly the vendor unveiled a new implementation methodology to help customers go live quicker.

| Morini introduces the connected Workforce |

Roadmap Transparency– In the past WorkForce (like many other HCM vendors) was not a poster child for transparency, luckily for customers, this has changed. And WorkForce shared a three year roadmap, with the usual caveats, but quite a difference to what was shared two years ago (the last user conference I was able to attend). No surprise – unification is a key theme across the coming release, with some vertical capabilities and most importantly a much needed UI improvement.

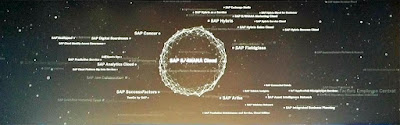

| WorkForce Software 2016 in review |

Hard work – will it be enough?– No question WorkForce has made a lot of progress, but the question remains, can the vendor catchup with the 800 pound gorilla of the industry, Kronos. In general the speed of vendors in WorkForce Management is increasing, with a strong focus on innovation, so WorkForce’s task is not getting easier. But plenty of room to differentiate, but the vendor now needs to get accelerate in delivery across the board, hence the blog post title.

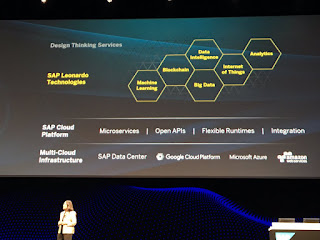

| Broady opens WorkForce Vision 2017 |

MyPOV

Good progress by the new WorkForce Software management team, no doubt. With more investment into product, focus on implementation speed, more partners, successful reseller relationships, and more – the vendor is executing the right strategies. Now they have to materialize and make a difference in the near future.

On the concern side, WorkForce Software has to bring together multiple platform at different levels, from architecture, data centers all the way to UI. And it needs to deliver the next generation of its product, taking advantage of cloud, microservices etc. and for all the talk on engagement, it must improve its user experience. The days of clumsy screens for power users are counted. To be fair, the vendor has realized that and plans a UI overhaul, architecture change and other improvements.

If it all will be enough to change the distance to the market leader, it is too early to tell, with no doubt WorkForce Software has positioned itself much better than where the vendor was a few years ago. We will have to check in again, stay tuned

More on WorkForce Software:

- News Analysis - WorkForce Software Announces Global Reseller Agreement with SAP - read here

- Progress Report - WorkForce Software powers into more Workforce Management - but needs to watch the Fundamentals - read here

More on Workforce Management:

- Event Report - Kronos KronosWorks - Solid progress and big things loom - read here

- Progress Report - Ceridian makes good progress, the basics are done now its about next gen capabilities - read here

- Event Report - Kronos KronosWorks - New Versions, new UX, more mobile - faster implementations - read here

- Event Report - Ceridian Insights - Momentum and Differentiation Building - read here

Find more coverage on the Constellation Research website here and checkout my magazine on Flipboard and my YouTube channel here.